For now, a profitable niche, but certainly a highly rewarding sector in the future.

It is a well-established fact that European football represents a constantly growing industry, with top clubs nearing the billion-dollar revenue threshold. Equally, it is a given that investment banks are always ready, at the right time, and where capital is needed.

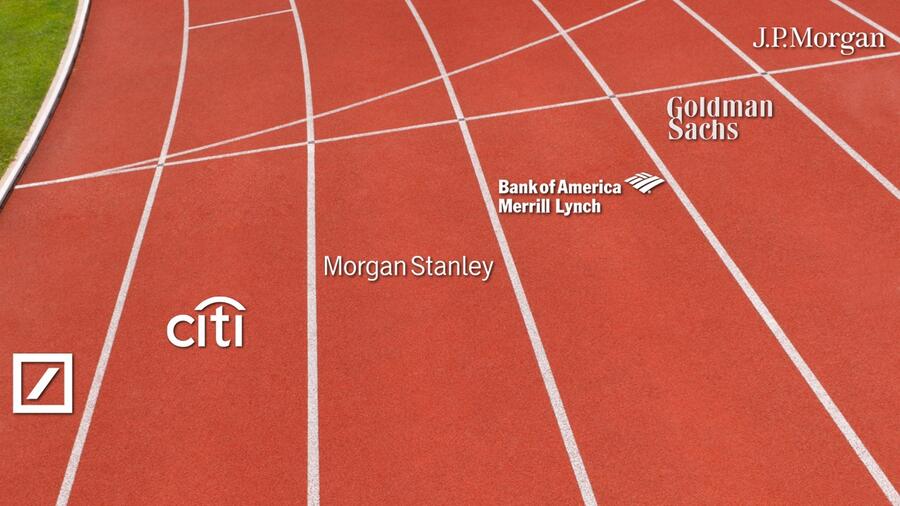

The “novelty,” however, lies in the arrival of the giants of the American banking industry into European football, offering advisory services and substantial financing to top-tier clubs.

As with nearly every product or service surrounding us, Sports Financing activities originated in the United States. It was in the U.S. that modern sports were conceived, where a sporting event is not just a “match” but a spectacle, and where they were the first to understand the importance of stadiums.

The Stadium Business

“How do we help the clubs become more competitive?” asked Greg Carey, Co-head of Infrastructure at Goldman Sachs and the mastermind behind the construction of over 40 sports stadiums worldwide. The expected answer was, “By building better facilities so they can put more money into the team, so they can be potentially better and play in the Champions League and make more money. So, it’s a virtuous cycle.”

Since the 1990s, Bank of America and Goldman Sachs have been financing ambitious construction and renovation projects for NFL, MLB, or NBA teams’ stadiums, and have supported the growth of Major League Soccer. It is this know-how—the ability to understand the peculiar financial logic of a sports club, whose operational and sustenance rules differ from those of any other company—that allowed these banks to break into European football when local banks’ ability to lend money diminished, and the reliance on the market increased.

In May 2017, Goldman Sachs and BAML secured £400 million for Tottenham’s new stadium, which was later increased by another £237 million in late 2018, partly with HSBC’s involvement. Barcelona also turned to Goldman Sachs for over $400 million for the new Camp Nou, although a definitive agreement has not yet been announced.

Recently, Real Madrid turned to JP Morgan for over $600 million for the ambitious new Santiago Bernabéu project. Various investors are approaching Milan and Inter for the new San Siro. One thing is certain: another hefty check from the U.S. will be written. Meanwhile, behind Roma’s new stadium, the Istituto per il Credito Sportivo (Sports Credit Institute) and Goldman Sachs seem to be involved, as was the case with Juventus for both their stadium and the Vinovo training center.

Debt Refinancing

Another booming business is debt refinancing, which allows companies to extend the duration of their debt, possibly reducing its cost, while banks earn lucrative commissions.

Inter and Roma utilized this in 2015, carrying out highly creative financial operations, where, after trademark sales and the creation of new companies, they secured 230 million and 175 million, respectively.

Manchester United, following its expensive acquisition through a Leveraged Buy-Out in 2006, has also resorted to various refinancing operations over the years.

Bonds, Securitization, and Factoring

Finally, there are three more services that companies increasingly turn to, in which banks play a fundamental role.

The use of bonds was recently seen with Juventus, which, with the assistance of Morgan Stanley and UBI Banca, issued a €175 million bond. Manchester United also issued a $425 million bond in 2015. Tottenham is also reportedly considering issuing a bond to reduce its banking exposure and debt costs.

With securitization and factoring, companies can solve the problem of highly seasonal revenues by selling their future cash flows from ticket sales and broadcasting rights at a discount and in advance to meet very short-term needs (e.g., paying salaries). Inter, under Thohir’s management, was a pioneer in this activity, selling a third of future ticket revenue for the 2016 season for €9 million to meet cash flow needs.

Therefore, although somewhat delayed compared to other sports, football—especially European football—is experiencing the presence of large American banks, which, in exchange for substantial fees, offer a variety of products and services to establish long-term relationships and ensure growth.

Credits to Martino Bernocchi

Lascia un commento